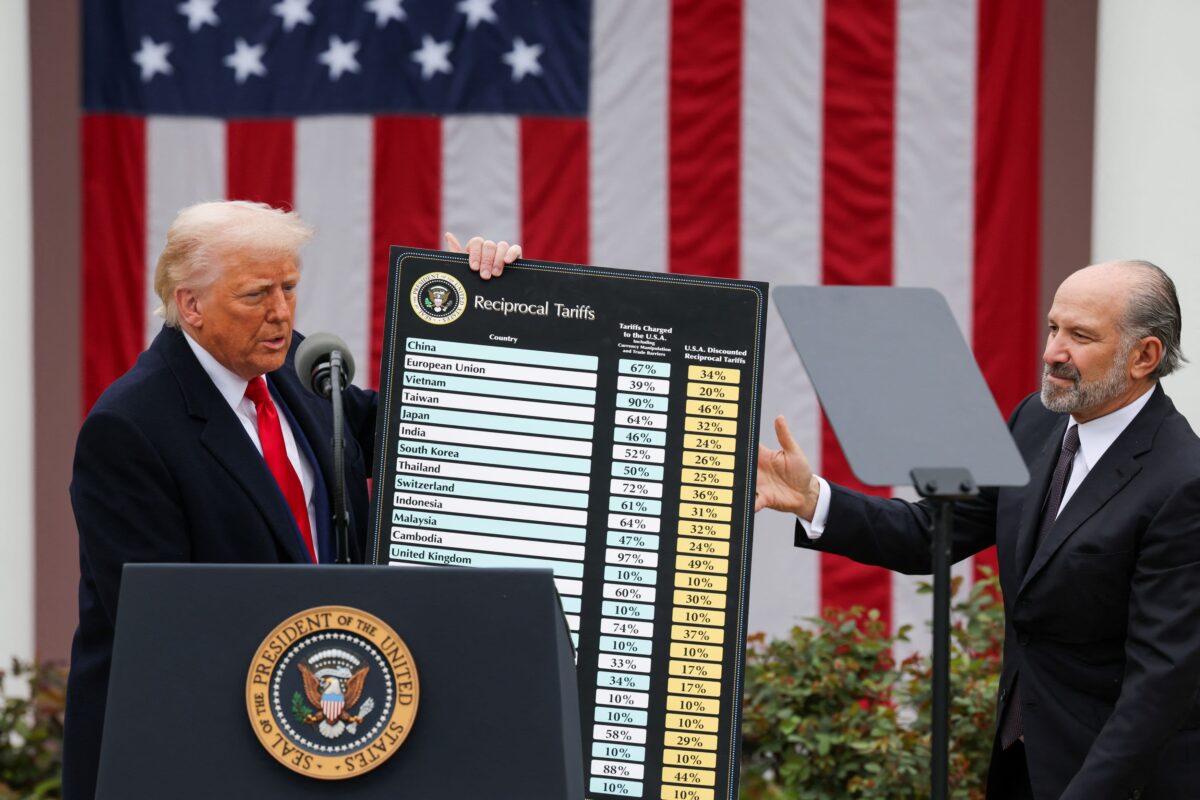

Recently, President Trump has slapped heavy tariffs on most of America’s trading partners, with most countries in the 15% to 20% range. For Canada, however, the number is 35%. China is in the worst position. President Trump intends to extend America’s tariff truce with this country, threatening a 40% tariff on all goods and an even higher rate for technologies and cars.

A tariff truce is a temporary suspension in either imposing or raising tariffs on trading partners, usually to reduce trade tensions and allow time for further negotiations.

Amidst a tariff crisis, economists express concerns over who will bear the costs. Consumers think they will absorb the tariffs as they have to pay more for essential goods – a complete pass-through of tariffs in domestic prices of imports. The Trump administration, however, has reiterated many times that foreign companies and suppliers must be the bearer, and US consumers should be left unscathed, but many economists and Americans regard this message with skepticism.

Trump stated that Walmart must absorb the tariff costs

The data might support the argument put forward by Trump. In June America’s “core” consumer prices (ie, excluding food and energy) rose by 0.2% on the previous month, below the consensus estimate of 0.3%. Researchers and market analysts have also found little evidence of tariff-induced price increases. It turns out that foreign suppliers are, indeed, shouldering the excess costs by accepting lower profit margins.

This is surprising given how hardly we see companies acting so benignly (they often pass the costs to partners or consumers). So what explains those surprising results?

Some point to the already high inflation rate in the US, which is financially straining millions of Americans. Consumers, therefore, show little tolerance for further price increases.

Americans reel from inflation’s impact

Brands might want to project a more favorable image as socially responsible companies that prioritize the interests of consumers over commercial gains. Heightened perception among US consumers might grant those “ostensibly benign” brands an advantage in terms of market share.

Strategic overstocking also allows companies to better absorb the effects of tariffs. Some economists posit that those firms are simply in good financial position to bear the costs, at least for a few years. Aggregate margins of listed companies in emerging markets have become fatter over the past decade, increasing by over two percentage points.

– Tran Khanh Huyen