As global trade shifts, Morocco is rising as a new manufacturing hub, fueled by heavy investment and booming exports. Yet its reliance on foreign firms and exposure to tariffs raise questions about long-term sustainability.

As President Trump’s trade wars upend the global market, multinationals rush to find alternatives to China. China offers generous subsidies to foreign investors and a workforce whose technological sophistication is unmatched by other nations’. These advantages are cemented by the country’s 1.4 billion population, which provides an abundant and cheap source of labor (align well with the core principles of globalization: minimize cost and maximize productivity). Citing these factors, many experts believe China’s position is unshakeable, but there is one nation that has been steadily climbing the ladder to become the world’s manufacturing and trade center: Morocco.

Morocco’s position on Europe’s southern doorstep has helped insert itself into global supply chains. Also, the country has secured about 40 billion of greenfield investment, making it one of the largest recipients. Such an enormous investment helps the country actualize its grand ambition. Many attribute this success to the host of investor-friendly policies that the country’s leader introduced. His government has invested heavily in building and upgrading public infrastructure, constructing railways and ports to ease traffic congestion. Morocco allocated at least 25% of its GDP a year on infrastructure alone from 2001 to 2017, making it one of the largest spenders. Besides, the government offers financial inducements – tax breaks, priorities to land acquisition, research grants – to lure foreign firms. These factors demonstrate the country’s investor welcomeness and its willingness to bend its will to investors.

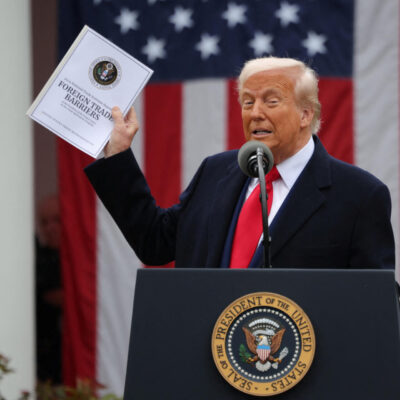

Yet, Morocco’s trading success is tied to European customers, raising concerns over reliance. However, the country has seen investment pouring from China. Firms from the Asian nation have forged close partnerships with the government and will invest 10 billion in car component and battery factories. However, connection with Chinese firms subjects Morocco to greater risks posed by Trump’s tariffs. The US President might regard the country as “a national threat” for aiding its biggest enemy and slap even heavier duties on Morocco.

Morocco may face greater risks from Trump’s tariffs

Also, creating favorable conditions for foreign firms at the cost of homegrown enterprises might blight the country’s prospects. A manufacturing-centric economy results in rising wages, but this increase does not coincide with local technological advancements if the government fails to support local companies. Soon, Morocco might be too expensive for labor-intensive manufacturing but too unsophisticated for technological innovation, a classic middle income trap.

Recognizing these challenges, Morocco’s government seeks to diversify their economy by investing in African countries.

– Bui Hai Dang